U.S. Stocks Rise as Investors Hope for a Federal Reserve Pause

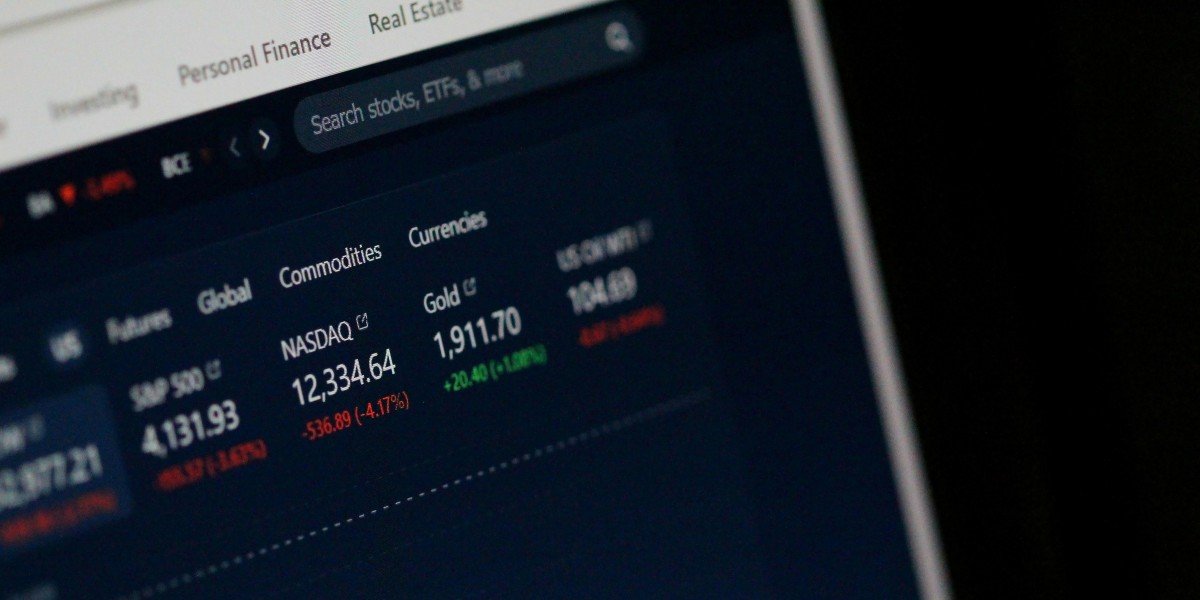

The U.S. stock market experienced a steady climb recently as investors began to hope for a break in interest rate hikes. This upward movement suggests that many people in the financial world believe the Federal Reserve, often called the Fed, might stop raising rates soon. Because higher interest rates make borrowing more expensive for companies and individuals, a pause is usually seen as good news for the economy. Key Market Movements The NASDAQ, which includes many technology companies, saw a gain of 0.75%. The S&P 500, an index that tracks 500 of the largest companies in the U.S., rose by 0.30%. While these gains might seem small, they indicate a shift in how investors feel about the future. Certain parts of the market performed better than others. Real estate and utility companies led the way. These sectors are known for being sensitive to interest rates. When rates are high, these companies often struggle because they carry a lot of debt or offer dividends that look less attractive compared to savings accounts. When investors expect rates to stay the same or go down, these stocks often become more popular. Understanding the Fed Pause The Federal Reserve has been raising interest rates