As we step into 2025, the global economy faces a complex and evolving landscape shaped by macroeconomic forces, geopolitical dynamics, and technological advancements. Understanding these trends is essential for policymakers, businesses, and investors seeking to navigate the challenges and capitalize on emerging opportunities. This article explores the key factors influencing the global economic outlook for 2025, providing insights into growth projections, inflation, trade dynamics, and sectoral trends.

Read also: Gas Companies Eye Expansion into Renewable Energy

Global Growth Projections

Modest Growth Expected

Global economic growth in 2025 is projected to stabilize at 3.2%, continuing the trend from 2024. Advanced economies are expected to experience moderate growth of around 1.8%, reflecting a slight improvement from the previous year. Meanwhile, emerging markets and developing economies may see a marginal slowdown, with growth rates hovering around 4.2%. These figures highlight the challenges faced by both developed and developing nations in achieving robust expansion amidst lingering uncertainties.

Inflation Trends and Their Impact

A Decline in Inflation Rates

Global inflation rates are expected to decline steadily, offering some relief after years of heightened price pressures. In 2025, inflation is projected to fall to 4.5%, down from 5.9% in 2024. Advanced economies are likely to return to their inflation targets sooner than emerging markets, aided by effective monetary policies. However, inflation remains a key concern, particularly in regions where structural issues persist.

Monetary Policy and Interest Rates

Central Banks Maintain Vigilance

Central banks worldwide continue to grapple with balancing inflation control and economic growth. Elevated interest rates, aimed at curbing inflation, are expected to persist in 2025, potentially dampening borrowing and investment activity. The possibility of “higher-for-longer” interest rates poses challenges for consumers and businesses alike, highlighting the importance of adaptive financial strategies.

Geopolitical Tensions and Trade Dynamics

Trade and Policy Uncertainty

Geopolitical tensions and trade dynamics remain critical factors shaping the global economy. Escalating trade disputes and policy uncertainty disrupt supply chains and international commerce, creating challenges for global trade. In 2025, these tensions are expected to persist, influencing the strategies of multinational corporations and governments alike.

Regional Conflicts and Economic Policies

Ongoing regional conflicts and geopolitical uncertainties continue to affect economic stability and investor confidence. Policymakers must navigate these challenges to foster growth and maintain global cooperation in trade and investment.

Public Debt and Fiscal Policies

Managing High Debt Levels

High public debt remains a pressing issue for both advanced and developing economies. Governments face the challenge of balancing fiscal consolidation with the need to support economic activity. The withdrawal of fiscal stimulus measures, combined with elevated debt levels, underscores the importance of prudent fiscal management in 2025.

Sectoral Performance and Investment Trends

Technology and Artificial Intelligence

The rapid integration of artificial intelligence (AI) and other technological advancements continues to drive growth in the tech sector. Companies leveraging AI to enhance efficiency and innovation are likely to maintain a competitive edge in 2025.

Energy Sector Dynamics

Shifts toward sustainable energy and regulatory changes significantly impact the energy sector. Investments in renewable energy sources and the transition to cleaner technologies are expected to shape the energy landscape, influencing both economic growth and environmental sustainability.

Regional Economic Outlooks

United States: Resilience Amid Challenges

The U.S. economy demonstrates resilience, with steady growth supported by consumer spending and technological innovation. However, potential policy changes, including tariffs, could influence future economic performance.

China: Navigating Structural Challenges

China faces economic challenges, including a struggling real estate sector and subdued growth in industrial production. These factors may impact the nation’s ability to meet its ambitious growth targets in 2025.

Eurozone: Stagnation and Structural Issues

The eurozone is likely to experience another year of stagnation, with minimal growth expected. Structural issues, such as labor market rigidity and fiscal constraints, continue to weigh on economic prospects in the region.

Risks and Uncertainties

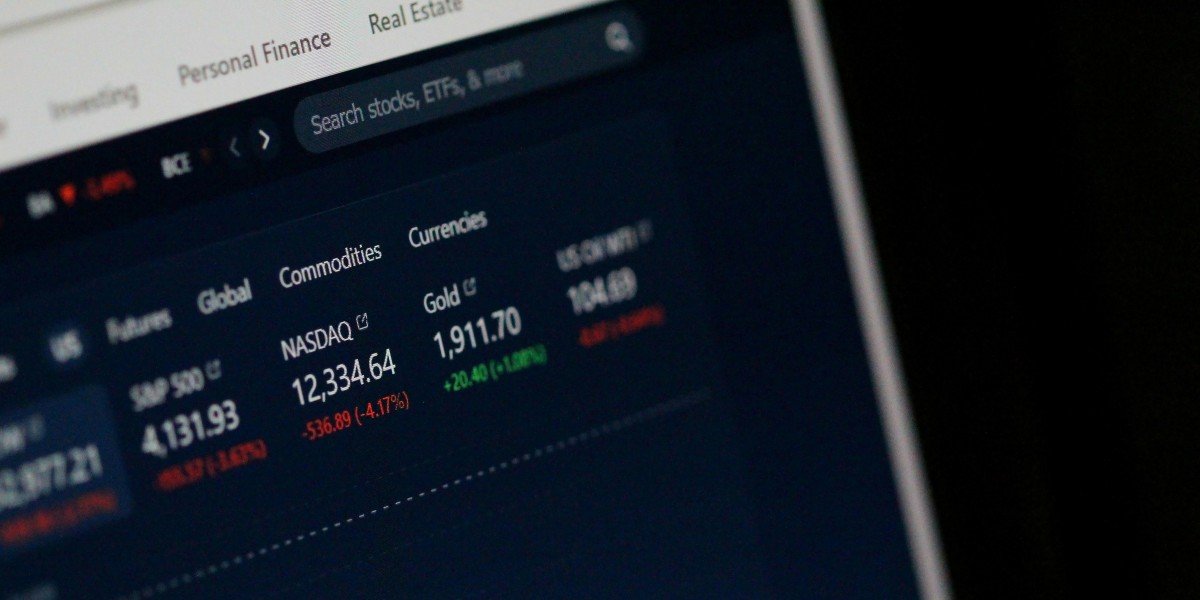

Market Volatility

Uncertainty surrounding interest rates and market conditions poses significant risks to the global economy. Market volatility is expected to persist, influencing investment strategies and financial stability.

Cybersecurity Threats

The rising prevalence of cybersecurity threats underscores the importance of investing in digital resilience. As economies become increasingly digitalized, ensuring robust cybersecurity measures will be critical for safeguarding economic stability and growth.

Strategies for Navigating the 2025 Economy

Diversify Investments

Investors can mitigate risks associated with market volatility by diversifying their portfolios across asset classes, regions, and sectors. Diversification ensures resilience against unforeseen economic shocks.

Monitor Inflation and Interest Rate Trends

Staying informed about inflation trends and central bank policies enables individuals and businesses to adapt their strategies to changing economic conditions. Proactive planning is key to managing the impact of inflation and interest rates.

Embrace Technological Innovations

Organizations that adopt and integrate technological advancements, such as AI and automation, can enhance productivity and competitiveness. Leveraging technology is crucial for staying ahead in a rapidly evolving economic landscape.

Read also: Exploring the Benefits of Diversifying Your Stock Portfolio

Preparing for a Dynamic Economic Landscape

The global economic outlook for 2025 presents a mix of opportunities and challenges. While modest growth and declining inflation offer reasons for optimism, geopolitical tensions, high debt levels, and market uncertainties demand cautious optimism and strategic planning.

By understanding these trends and adapting to the evolving economic environment, individuals, businesses, and policymakers can navigate the complexities of 2025 with confidence. Whether through diversification, embracing innovation, or prudent fiscal management, the strategies outlined in this article provide a roadmap for thriving in a dynamic global economy.