Silver has been catching the eye of investors and analysts in recent months, as its price has been climbing at a faster pace than gold. Traditionally, gold has dominated the precious metals market, but silver’s recent rally is driven by a unique set of supply constraints, industrial demand, and shifting economic dynamics. As silver prices reach levels not seen in years, it’s crucial to understand the underlying factors driving this market shift.

The Supply Squeeze Driving Silver’s Price Surge

One of the primary reasons silver is outperforming gold is the ongoing supply squeeze in the global market. Unlike gold, which is primarily used for investment and jewelry, silver has a significant industrial component in its demand. From electronics and solar panels to electric vehicles and medical devices, silver’s role in various industries has been steadily increasing.

According to data from the Silver Institute, global mine production of silver has been relatively flat over the past few years, while industrial demand has surged. This mismatch has created a supply crunch that is pushing prices higher. As major mining companies struggle to meet growing demand, the tight supply conditions are providing a substantial boost to silver’s price.

In addition, silver’s relatively small market size compared to gold makes it more susceptible to price swings. While gold has an established market with large institutional investors, silver’s smaller market means that even moderate shifts in supply or demand can result in significant price movements.

Industrial Demand Boosting Silver’s Appeal

Industrial demand for silver is at an all-time high, contributing significantly to the metal’s recent rally. The rise in green energy technologies, particularly solar panels, has placed silver at the forefront of global industrial demand. Solar panels use silver for their conductive properties, and as the world continues to move toward renewable energy, the need for silver in this sector is expected to increase.

The electric vehicle (EV) sector is another major driver. EVs require silver for components like batteries, connectors, and electrical systems. As EV adoption accelerates, the demand for silver in automotive manufacturing is expected to grow exponentially. This industrial demand, coupled with the supply shortages, has been pushing silver prices higher, making it one of the most sought-after commodities in recent months.

Silver’s Relative Affordability Compared to Gold

Another factor that makes silver particularly appealing to investors right now is its relative affordability compared to gold. While gold has traditionally been seen as the “safe-haven” asset in times of uncertainty, silver is now being viewed as a more accessible option for investors looking to capitalize on the rally in precious metals.

Silver’s lower price point allows investors to acquire more of the metal for the same investment amount, making it an attractive choice for those looking to hedge against inflation or economic instability. As central banks continue to hold interest rates low and governments spend on stimulus, many investors are turning to precious metals as a store of value. With silver’s more affordable price tag, it has become an easier entry point for a wider range of market participants.

A Broader Market Trend: Precious Metals and Inflation Hedge

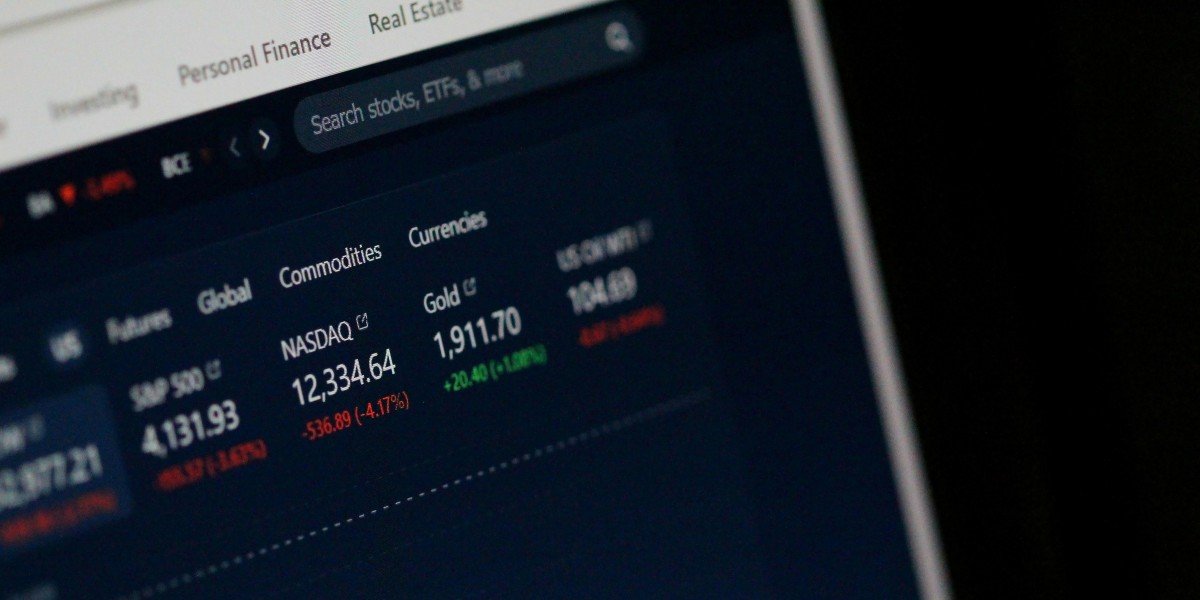

Photo Credit: Unsplash.com

Precious metals, particularly gold and silver, have long been seen as a hedge against inflation and currency devaluation. In recent years, inflationary pressures have been a key concern for investors, especially in light of global economic stimulus measures and rising production costs. With central banks worldwide maintaining loose monetary policies, there is growing uncertainty about the value of fiat currencies.

Both gold and silver have traditionally benefited during times of inflation, but silver’s industrial applications give it a unique advantage over gold in the current market environment. As the world continues to battle supply chain disruptions and inflationary pressures, silver’s price surge could be seen as a reflection of both its investment appeal and its essential role in the global economy.

The Future of Silver Prices: What Investors Should Expect

The outlook for silver remains positive, with several factors indicating that the precious metal could continue to outperform gold in the short term. First, the supply-demand imbalance shows no signs of easing, with mining output expected to remain stagnant while industrial demand rises. Additionally, the green energy revolution and the global push toward electrification will continue to drive silver demand in the coming years.

However, there are potential risks that could impact silver’s upward trajectory. Global economic slowdown or tighter monetary policies could reduce industrial demand for silver, particularly in the solar and electric vehicle sectors. Furthermore, silver’s volatility relative to gold means that price fluctuations could occur more frequently, which may be a concern for more conservative investors.

Despite these risks, silver’s ability to outpace gold’s rally in recent months highlights its potential as a key player in the precious metals market. Investors looking to capitalize on this trend should consider diversifying their portfolios to include silver as a way to hedge against economic uncertainty and inflation.

As the silver supply squeeze continues to tighten, the precious metal’s role in the market will only become more significant. For investors, understanding the factors driving silver’s price surge is crucial for making informed decisions in the volatile world of precious metals.